James Wynn Returns to Futures with $2M Deposit on HyperLiquid

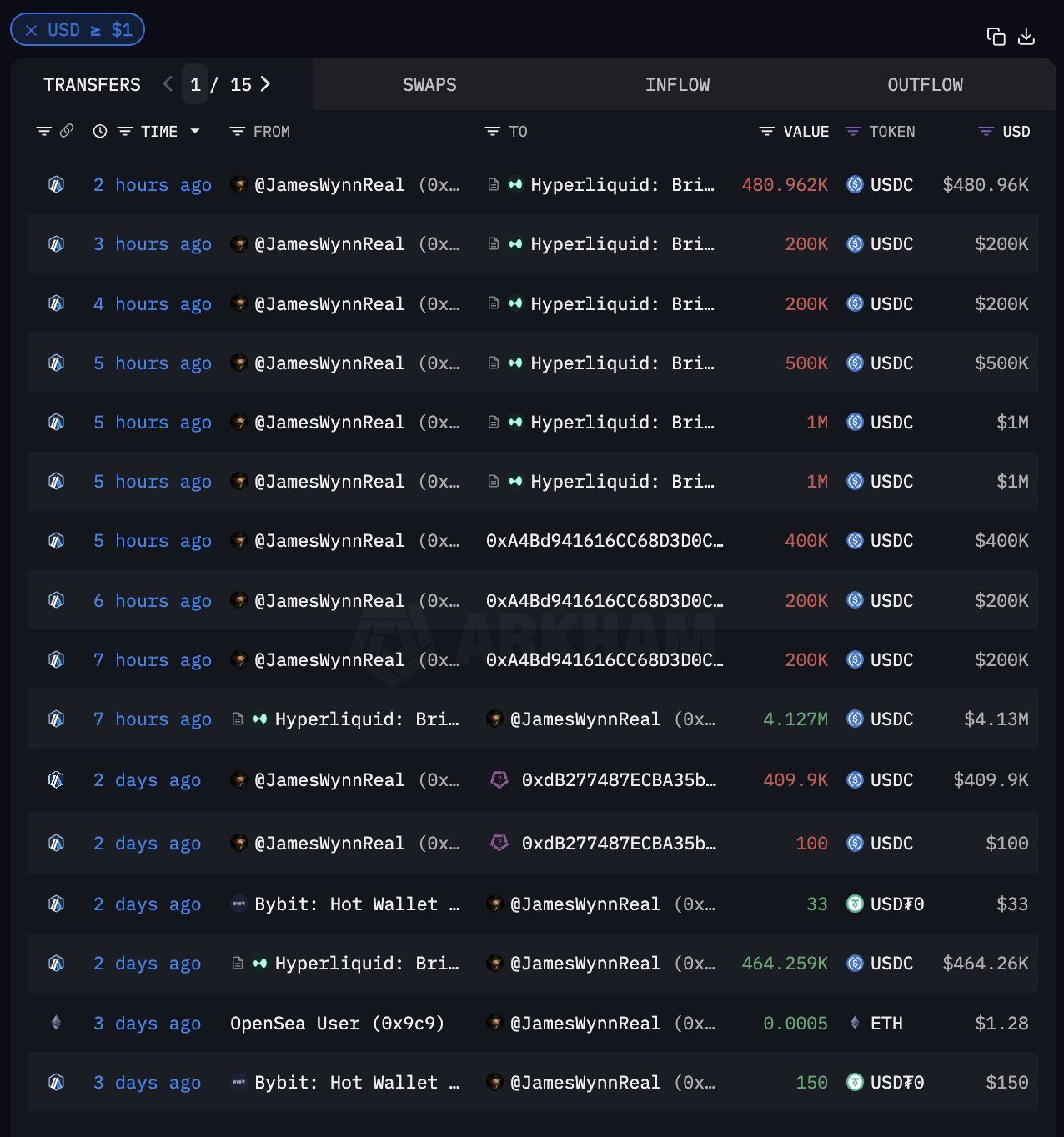

James Wynn has made a dramatic return to the world of perpetual futures trading just two hours after publicly announcing his retirement from the practice. According to on-chain data, Wynn deposited over $2 million into HyperLiquid, and immediately opened a high-leverage position – reportedly a 40x long.

This move comes on the heels of a recent rollercoaster trading journey that has cemented Wynn as one of the most talked-about figures in the crypto derivatives scene.

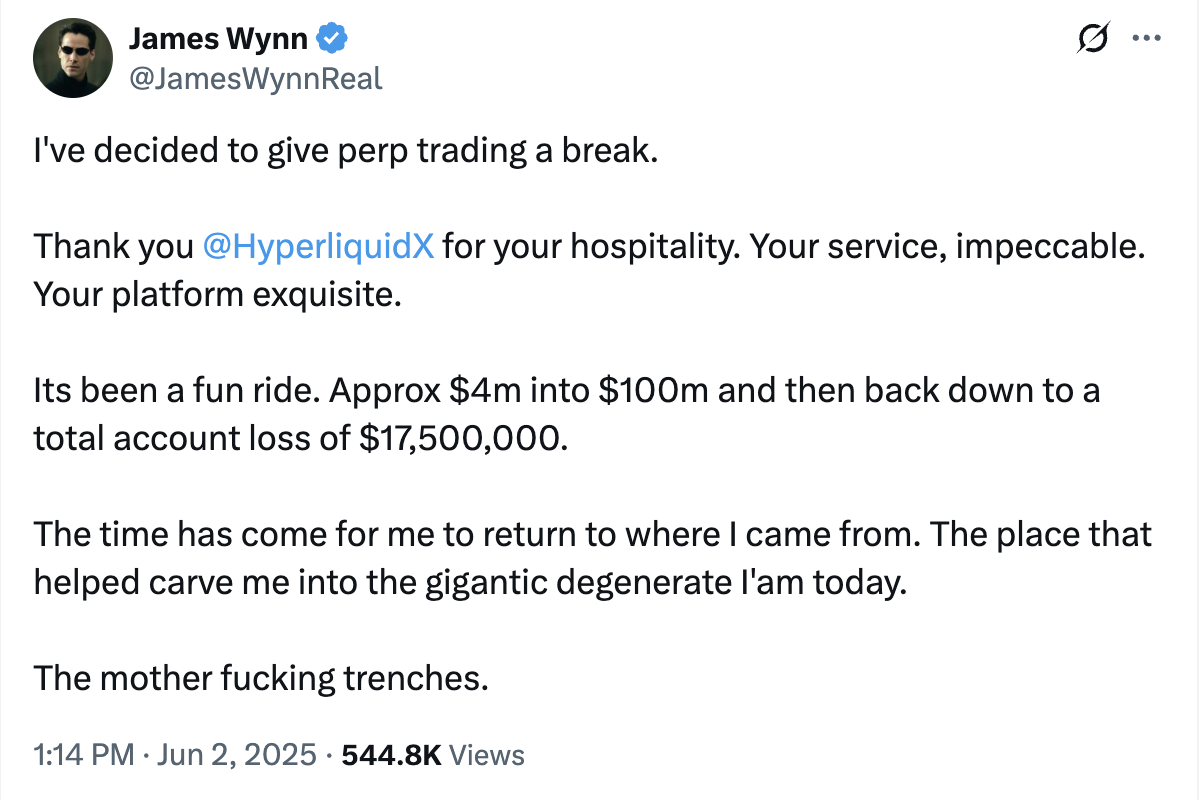

Having turned an initial $4 million investment into more than $100 million earlier this year, Wynn’s fortune took a sharp reversal. His losses eventually totaled over $17.5 million, a saga that led to his now-deleted statement declaring an end to his perp trading days:

“I’ve decided to quit perpetual trading. Thanks Hyperliquid for the journey.”

But Wynn’s farewell was short-lived.

Read more: Bitcoin Whale James Wynn Faces Massive Liquidation Worth $100M

From the Depths of Liquidation to the Brink of Another Gamble

Just hours after stepping away, Wynn returned to his platform of choice, HyperLiquid, where he now appears to be attempting a comeback. The newly opened 40x long position already shows a floating loss of over $900,000 at press time.

With Bitcoin hovering around $104,000, liquidation for his position would occur should the price dip further.

Further fueling the buzz, Wynn reportedly unstaked and sold $4.1 million worth of $HYPE for USDC before jumping back into the futures arena. He then placed a massive Bitcoin long, estimated to be worth close to $100 million in notional value. As of now, he is down 73% on the position, underscoring the extreme volatility of his trading strategy.

Source: Arkham

Controversy Behind the Fame

Despite being seen as an idol in the HyperLiquid trading community, Wynn has not escaped criticism. Some community members have accused him of promoting low-quality “meme coins” for financial gain, only to quietly exit his positions once prices spike. While such claims remain unverified, they’ve added to the polarizing image surrounding Wynn’s trading persona.

Critics have also noted that most seasoned traders with Wynn’s capital would typically divide their capital across multiple trades and maintain discretion to avoid targeted liquidations. Wynn, however, has taken the opposite approach – publicly showcasing massive positions and frequently posting updates to X, effectively turning his portfolio into a live media campaign.

This public strategy has drawn attention not only to his trades but also to tokens associated with him, such as memecoin MOONPIG.

Although it’s unclear whether his actions amount to market manipulation, there’s little doubt that Wynn has created one of the most effective marketing funnels in the memecoin space.

There are even speculations that Wynn operates multiple wallets to hedge or balance trades behind the scenes. Some believe he only promotes the most successful wallet publicly to build a reputation and attract followers.

Source link