Billionaire Ray Dalio Backs 15% Allocation to Bitcoin and Gold Amid U.S. Debt Spiral

Bridgewater Associates founder Ray Dalio is calling for investors to allocate 15% of their portfolios to bitcoin (BTC) or gold, citing heightened risks from the U.S.’s accelerating debt burden and long-term currency devaluation.

“If you were optimizing your portfolio for the best return-to-risk ratio, you would have about 15% of your money in gold or Bitcoin,” Dalio said on the Master Investor podcast Sunday.

The comments mark a notable shift from his 2022 recommendation of just 1–2% in BTC, reflecting growing concern over what Dalio calls a “debt doom loop.” He pointed to a projected $12 trillion in new Treasury issuance over the next year, required to service the U.S.'s $36.7 trillion national debt.

A U.S. Treasury report on Monday confirmed the trend, with the government expecting to borrow $1 trillion in Q3, $453 billion more than previously forecast, followed by $590 billion in Q4.

Dalio, who still favors gold over bitcoin, described both as “effective diversifiers” in a scenario where fiat currencies lose value relative to hard assets. Still, he maintains skepticism about the asset's role as a reserve currency, citing concerns about surveillance and the transparency of the blockchain.

“Governments can see who is doing what transactions on it,” he said, adding that any code-level vulnerabilities could undermine Bbtcoin’s credibility as an alternative money.

While Dalio owns “some Bitcoin,” he framed his updated 15% recommendation as flexible: The specific ratio of BTC to gold is “up to you,” he said.

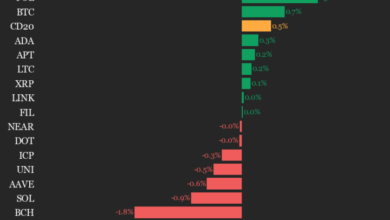

BTC trades just over $118,000 in Asian morning hours on Tuesday.

Source link