ZORA Coin 10x Rally in 2025: Hype or Structural Breakthrough?

In a year already saturated with market rallies and speculative euphoria, few tokens have stolen the spotlight quite like ZORA in 2025. Within mere weeks, ZORA skyrocketed by over 900%, igniting fervent interest across the crypto ecosystem. Once regarded as a quiet infrastructure protocol on Ethereum Layer 2, ZORA unexpectedly evolved into the centerpiece of a resurging SocialFi movement.

What catalyzed this explosive move? Was it merely another hype-fueled rally, or does it represent a deeper structural shift toward decentralized media, creator monetization, and Web3-native social engagement?

From Coinbase Wallet to SocialFi Engine

The turning point came when Coinbase rebranded its wallet as the “Base App,” shifting its purpose from a standard self-custodial solution to an integrated social application embedded within the Ethereum Layer 2 ecosystem. At the heart of this transformation was a powerful innovation: Creator Coins—on-chain tokens minted for individual posts, tradable directly by users.

The Creator Coins function supports permissionless minting, content ownership, and trading. The combination of Zora and Farcaster—a decentralized social network—supercharged user activity. According to data from The Block and Bankless, daily token creations soared from approximately 4,000 to over 38,000 in just three weeks.

ZORA, the protocol’s native token, became the implicit index bet for this entire trend. With Coinbase backing the Base ecosystem, investor confidence skyrocketed, leading to a surge in spot and futures volume and a 10x price increase in under a month.

According to CoinGecko, ZORA gained 21.6% on July 17 alone following its integration with Base App.

NEWS: $ZORA is up 21.6% after its integration with the rebranded @baseapp app. pic.twitter.com/Oldeqlt3I1

— CoinGecko (@coingecko) July 17, 2025

SocialFi Momentum Meets Market Speculation

The rise of ZORA fits within a broader 2025 trend: the resurgence of SocialFi. After a lull post-2021, the SocialFi sector has re-emerged, bolstered by low-cost Layer 2 infrastructure and the rise of decentralized social platforms like Farcaster. Zora’s economic model directly capitalized on this revival.

For more: Everything You Need To Know About NFT Art Marketplace Zora

The mechanics were simple but powerful. A user creates content; that content is minted into a token; traders buy and sell those tokens on Uniswap or integrated social DEXs. Traders speculate on post popularity, while creators earn transaction fees on each trade. In this context, ZORA became more than a governance token. It turned into the “de facto platform token” for a new form of creator monetization—earning on attention, not ad clicks.

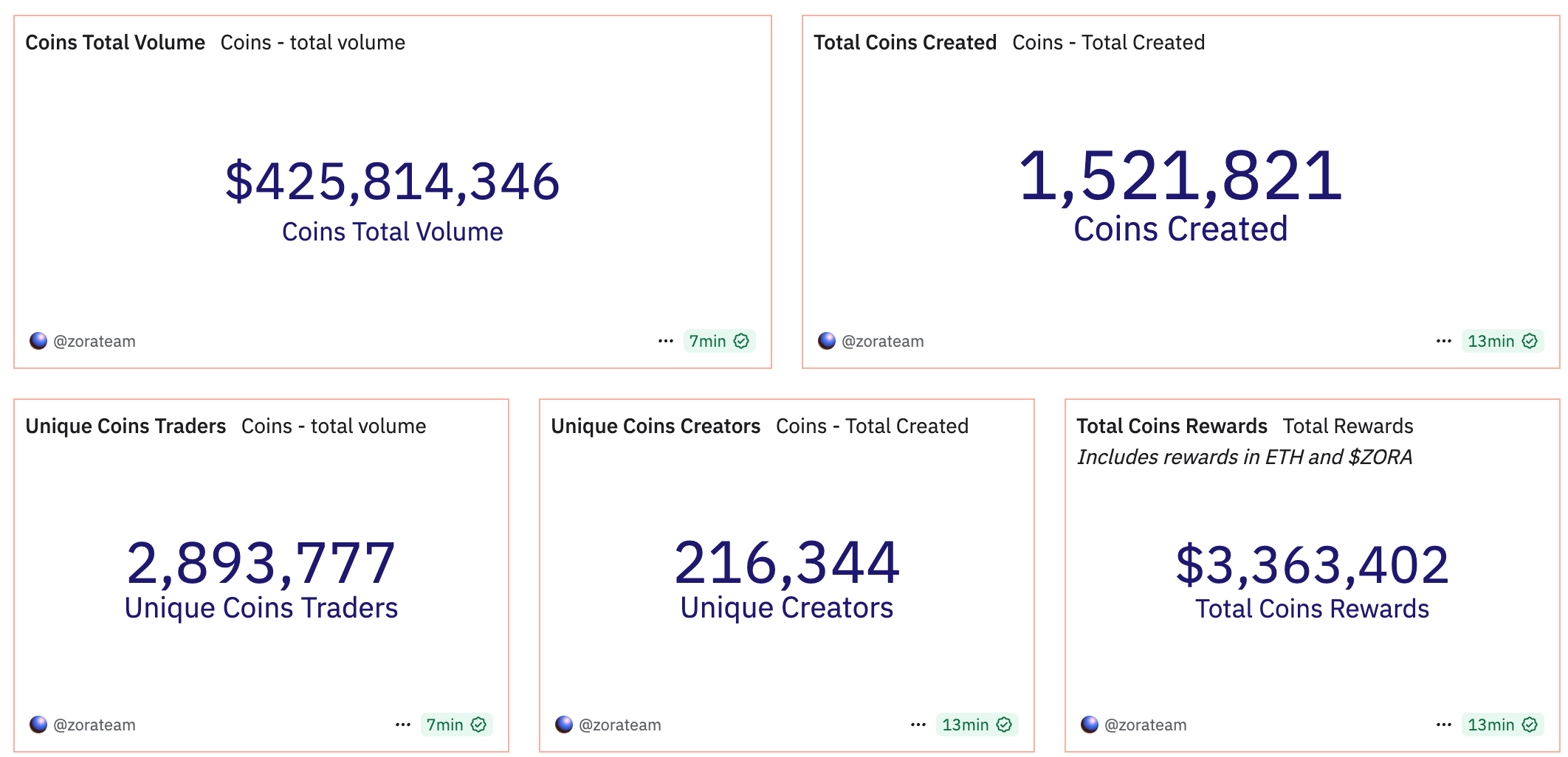

Source: Dunes

Based on data from DeFiLlama and CoinGlass, over 1.5 million Creator Coins were minted between June and July 2025. SocialFi-linked contracts saw $425 million in cumulative trading volume, and ZORA futures open interest surpassed $100 million just days after the Base App integration.

Source: Coinglass

Technical and On-Chain Confirmation

Market behavior wasn’t purely speculative. On-chain and exchange metrics confirmed a shift in investor profile. According to CoinGlass, ZORA token balances across centralized exchanges dropped from over 6 billion to under 4.5 billion during the rally. At the same time, whale wallet concentration increased by 8%, indicating accumulation by large holders.

Source: Coinglass

Such metrics typically indicate accumulation by large holders, suggesting confidence in the token’s long-term utility. Meanwhile, ZORA’s MACD and RSI indicators flipped bullish just before the major breakout above $0.01, a key resistance level.

Moreover, Binance’s listing of ZORA perpetual futures with 50x leverage amplified momentum. The derivatives listing brought liquidity and allowed traders to take large directional positions on ZORA’s price, helping the token to rise more rapidly and draw additional attention.

The result was a flywheel: more volume led to more interest, which drove more volume, further tightening the token’s available supply and accelerating the rally.

Zora Liquidation Heatmap. Source: Coinglass

Is the Pump Justified?

From a fundamental standpoint, ZORA’s 10x pump appears both overblown and underappreciated—depending on one’s perspective. On one hand, the token’s utility is still relatively undefined. It serves governance purposes in the Zora DAO and is indirectly tied to the Creator Coin economy, but it does not confer direct rights to revenue or transaction fees. We clearly see the lack of direct economic capture weakens the token’s valuation base.

On the other hand, ZORA represents an emerging coordination asset in the SocialFi stack. If SocialFi is here to stay—and metrics indicate that it might be—then ZORA could become the ETH of a new Layer 3 ecosystem focused on attention, creators, and post-based assets. Similar coordination assets—ETH for DeFi, SOL for high-speed smart contracts, ARB for scaling—grew exponentially once their ecosystems matured. If ZORA continues integrating with Farcaster, Base, and new Layer 3 experiments, its role may expand dramatically.

What Can We Learn From This Rally?

The rise of ZORA offers several insights into the current state of crypto markets. First, narratives still matter—a lot. ZORA didn’t change its protocol overnight, nor did it suddenly add new revenue streams. What changed was the narrative around social media, ownership, and tokenized content. Coinbase’s involvement gave the ecosystem credibility, and that was enough to catalyze a wave of speculation and investment.

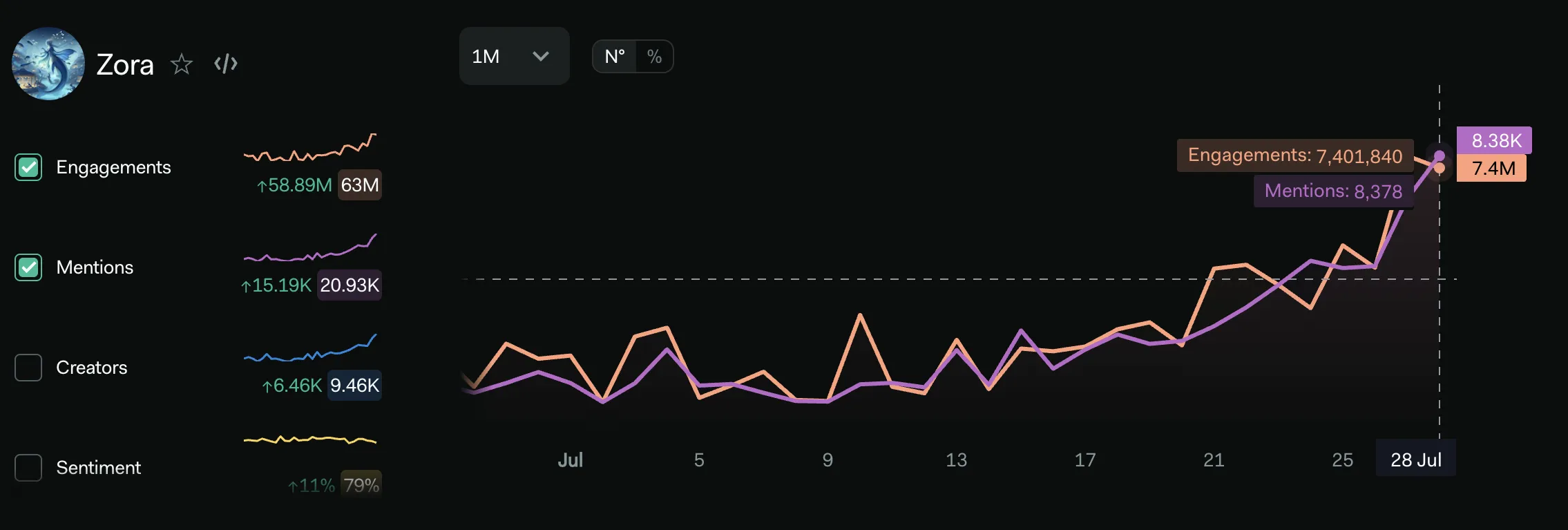

About Zora Engagements and Mentions. Source: LunarCrush

Second, infrastructure tokens with strong cultural resonance are outperforming more “technically sound” but less engaging alternatives. ZORA benefited not only from the Base network effects but also from its brand positioning among creators, artists, and open-source advocates. Its pump is a reminder that crypto is as much a culture market as it is a capital market.

For more: The Base Ecosystem is Facing a Major Growth Opportunity

Finally, the pump highlights that composability is the killer feature of Web3. Zora’s success wasn’t isolated. It was composable with Base, Farcaster, Uniswap, and other tools. The combination allowed new use cases to emerge without permission and value to accrue in unexpected ways. Projects that enable this kind of open experimentation will continue to be rewarded.

Structural Signal or Temporary Hype?

ZORA’s 10x rally in 2025 may seem speculative on the surface—and to a large degree, it is. But beneath that volatility lies a powerful signal: crypto is evolving beyond money and finance into culture and content. Zora Protocol sits at the intersection of this evolution, offering creators the ability to own, trade, and profit from their work in real-time, on-chain.

The price may correct, and the euphoria may fade. But the mechanics, tools, and narratives that drove ZORA’s rise are here to stay. As crypto moves into a new phase defined by identity, media, and social capital, ZORA may be the first of many tokens to capitalize not just on code, but on culture.