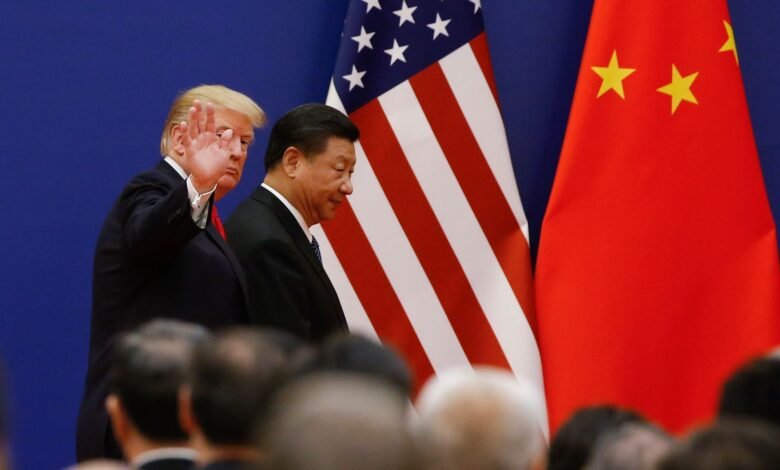

Retakes $110K as Trump Settles Metals Deal, Lowers China Tariffs

Bitcoin reversed some of the post-Fed losses early Thursday after the meeting between President Donald Trump and his Chinese counterpart Xi Jinping yielded favourable outcomes.

Speaking aboard Air Force One, the US president was also reported as saying it was a one-year agreement that would be extended. Trump also said the rare earths issue has been settled and there would be no more roadblocks on them.

Trump also said US tariffs on China would be lowered to 47% from 57%. He said he would be going to China in April and that Xi would come to the US at some stage after that, in comments carried by Reuters.

BTC briefly fell to $108,000, extending the overnight decline from $113,000 to $110,000, which was triggered by Federal Reserve Chairman Jerome Powell downplaying the certainty of a rate cut in December.

XRP and led losses among majors with a 4% slide. Ether , Solana’s SOL, BNB and Cardano’s ADA showed losses as much as 3%.

Futures tied to the S&P 500 also traded lower while the dollar index consolidated at around 99.00 holding on to overnight gains.

According to the BBC, Trump has left South Korea, without announcing the outcome of his talks with Xi. “They shook hands at the end of the meeting before departing,” the BBC report said.

The bar of expectations was set high after Trump said early this week that both nations are close to reaching a trade deal. Trade tensions ramped up recently after Trump threatened to impose 100% tariffs on Chinese goods in response to Beijing’s decision to strengthen its grip over rare earth exports.

Earlier on Wednesday, the U.S. central bank’s Federal Open Market Committee lowered its benchmark overnight borrowing rate to a range of 3.75%-4%. The Fed added it would be ending the reduction of its asset purchases – a process known as quantitative tightening – on Dec 1.

The twin policy shifts land squarely in crypto’s wheelhouse. A lower benchmark rate at 3.75%–4% signals the beginning of easier financial conditions after two years of restraint, softening real yields and supporting risk appetite.

Bitcoin and other non-yielding assets tend to benefit as liquidity returns and investors rotate out of cash-heavy positions into growth and alternative stores of value.

Ending balance sheet runoff on December 1 effectively reintroduces net liquidity to the system, easing pressure on banks and improving market depth across risk assets. That environment may spur risk-taking behavior among crypto traders and renewed leverage in derivatives markets.

The bigger swing factor remains geopolitics, however. If the U.S.-China trade deal solidifies and tariffs are further rolled back, global risk sentiment could surge, reinforcing the Fed’s dovish tone and extending Bitcoin’s rebound beyond $115,000. But if talks unravel, investors may unwind fresh longs as the dollar firms and volatility spikes again.

As such, easier monetary policy and easing trade friction form a rare alignment that supports crypto markets into November — though optimism still hinges on whether this “soft landing” narrative holds once liquidity truly returns.

#Retakes #110K #Trump #Settles #Metals #Deal #Lowers #China #Tariffs

Shaurya Malwa